How It Works & Pricing

Take Payments Without the Monkey Business

In the world of card payments, things can get messy fast. Long contracts, hidden charges, and confusing acronyms are how traditional providers keep you tied up. But at Gorilla Pay, we believe it shouldn’t be that way.

We make it simple to take payments with honest pricing, 30-day rolling contracts, and zero hidden extras. No snakes in the grass. Just fair, flexible deals that help your business take payments and grow.

Why We’re Different

Most providers love small print. They’ll promise low rates but bury charges in the fine details: PCI DSS compliance fees, “cardholder not present” surcharges, portal access charges, minimum monthly service fees, and even per-transaction authorisation fees. At just 3p to 5p a time, these can quietly add up to £90–£150 a month if you’re handling 100 transactions a day.

That means you could end up paying hundreds of pounds more every month than you expected. Worse still, most providers force you to sign multi-year equipment leases that make it nearly impossible to leave.

At Gorilla Pay, we flipped the script:

- No leases – You’ll never be trapped in a 4-year contract.

- No hidden fees – What you see is what you pay.

- No authorisation fees – We don’t sneak in per-transaction costs.

- No cancellation penalties – Leave any time with 7 days’ notice.

- No PCI DSS charges – Compliance should never cost you extra.

- Dual cameras - 2MP front and 5MP rear for scanning and mobile payments

We cut through the jungle and give you a deal that’s clear, fair, and easy to understand.

How It Works with Gorilla Pay

We keep things simple with just two agreements:

Service Agreement – 30-Day Rolling

All your transactions are charged the same way with Interchange Plus Plus pricing – no markups, no surprises, and absolutely no authorisation fees.

- Lower rates for debit-heavy businesses: Ideal if most of your payments come from consumer debit cards.

- Balanced pricing for mixed card types: A flexible solution for businesses handling a variety of card payments.

- Optimised fees for high-value credit and business cards: Perfect for industries with larger transaction sizes.

- Tailored pricing, not one-size-fits-all: We customise every solution to suit your business model and card profile.

And the best part?

- No increased charges for cardholder-not-present transactions

- No increased charges for corporate or business cards

- No PCI DSS compliance charges

- No PCI DSS non-compliance charges

- No smoke, no mirrors, no catch

- No minimum monthly service charges

- No authorisation fees eating into your profits

- No annual management fees

- No portal charges

Membership Agreement – 30-Day Rolling

No ties

Cancel with just 7 days’ notice

No cancellation fees

No transactions? No charges

It really is that simple.

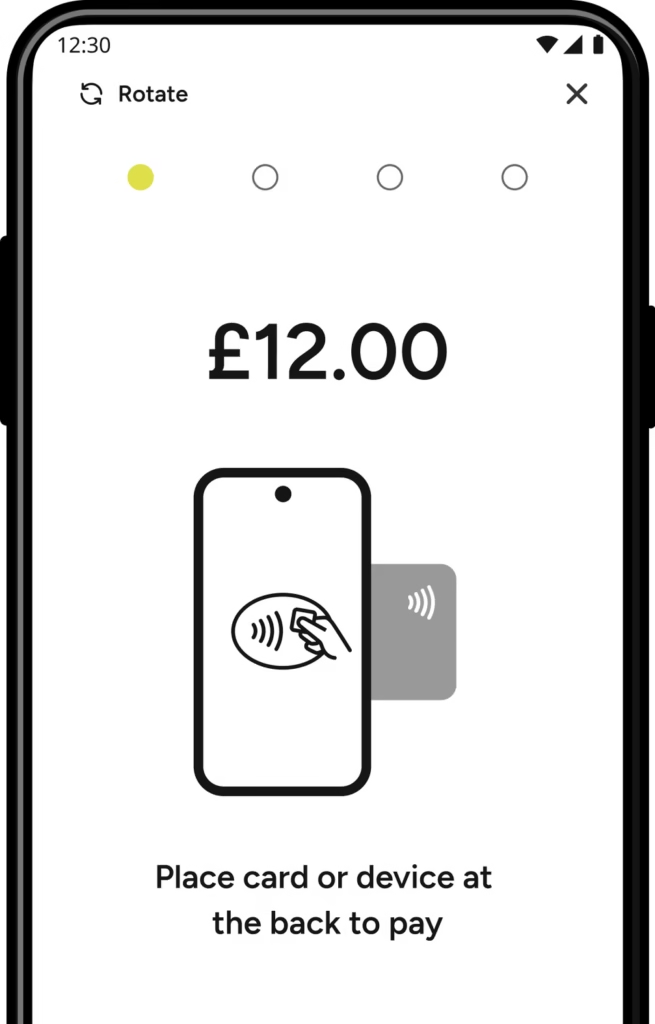

- £25.00 a month

- Free terminal

- Free refund

- Delivery £29.99

Why Businesses Choose Gorilla Pay to Take Payments

Thousands of UK businesses have already switched to Gorilla Pay to take payments.

Here’s why:

- Freedom – 30-day rolling agreements give you control.

- Fairness – The same rates for small shops as big retailers.

- Flexibility – Seasonal business? Return your terminal in quiet months.

- Transparency – No nasty surprises in your invoice.

- Support – UK-based technical help whenever you need it.

Whether you’re a café, shop, restaurant, or online store, Gorilla Pay makes it easier than ever to take payments.

Pricing at a Glance

Here’s how Gorilla Pay compares to traditional providers:

Our contracts are just 30 days, not the 3–5 years most others demand. We charge no PCI DSS fees, saving you £10–£30/month, and there are no minimum monthly service charges, so quiet periods don’t cost you.

Unlike others, we don’t increase rates for cardholder-not-present or corporate card payments, and there are no cancellation penalties, leave any time.

We also don’t lease machines. Where others charge £20–£50/month for equipment you’ll never own, ours come with a simple one-off cost.

A key difference? No authorisation fees. Most providers charge 3p–5p per transaction, adding up to £90–£150/month if you’re processing 100 sales a day, and many won’t tell you upfront.

With Gorilla Pay, there’s no small print. Just honest pricing and full transparency.

It’s a Jungle Out There, But We’ve Got Your Back

The payments industry is full of predators. Banks and providers love long contracts, sneaky charges, and confusing agreements that keep you locked in. But Gorilla Pay is different.

We’re here to help you take payments with confidence, clarity, and freedom. No tricks. No traps. Just a fair deal that works for your business.

The Gorilla Pay Pledge

We’re so confident you’ll love our service that we’ve put our promise in writing:

- If you’re not 100% satisfied within 60 days, return the equipment and get a full refund of your membership charges.

- After that, you can leave any time with no penalties.

Most providers would lose money with a pledge like this. Does that worry us? Nope. Because our deals are so good, very few customers ever leave.

Get in Touch

Ready to Take Payments the Smarter Way?

Stop paying more than you should. Stop worrying about contracts and hidden extras. Join the Gorilla Pay troop and discover how easy it is to take payments with honesty and transparency.

Get in touch today for a quote or to get started.

Gorilla Pay, It’s a jungle out there, but we’ll help you take payments the smarter way.

Our Blog

Latest Blog

How to Choose the Best Credit Card Payment Terminal for Your Business

Choosing the right credit card payment terminal is essential for any UK business that wants to accept secure, fast and...

What Is a Merchant Account and How Does It Work?

For any UK business accepting card payments, understanding what a merchant account is — and how it fits into the...

Top Features to Look For in Retail Merchant Services

In today’s fast-moving retail environment, customers expect quick, secure and flexible payment options. For UK retailers, choosing the right retail...